prince william county real estate tax records

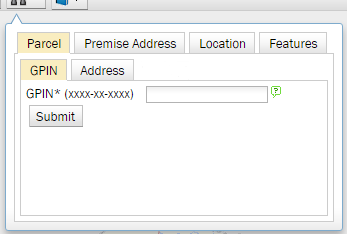

Submit Daily Rental Return. Enter street name without street direction NSEW or suffix StDrAvetc.

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

. 340200 9 hours ago the median property tax also known as real estate tax in prince william county is 340200 per year based on a median home value of 37770000 and a median effective property tax rate of 090 of property value. The Assessments Office mailed the 2022 assessment notices beginning March 14 2022. Prince William County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Prince William County Virginia.

Prince William County Real Estate Assessor 4379 Ridgewood Center Drive Suite 203 Prince William VA 22192 Prince William County Assessor Phone Number 703 792-6780. Prince William County Real Estate Assessor. Discover Prince William County Property Tax Records for getting more useful information about real estate apartment mortgages near you.

703 792 6000 Phone 703 792 7484 Fax Get directions to the county offices. Enter the house or property number. Search property records in Prince William County VA acquired from multiple public sourcesLook up for property description deeds title documentsFree registration.

The Prince William County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Prince William County Virginia. Effective tax rate Prince William County 00105 of Asessed Home Value Virginia 00082 of Asessed Home Value National 00114 of Asessed Home Value Median real estate taxes paid Prince William County 4010 Virginia 2234 National 2471 Median home value Prince William County 382400 Virginia 273100 National 217500 Median income. We Provide Homeowner Data Including Property Tax.

Please forward the bill to. NETR Online Prince William Prince William Public Records Search Prince William Records Prince William Property Tax Virginia Property Search Virginia Assessor From the Marvel Universe to DC Multiverse and Beyond we cover the greatest heroes in Print TV and Film. If you have questions about this site please email the Real Estate Assessments Office.

Prince william county accepts advance payments from individuals and businesses. The Prince William County seat can be found in the in Manassas. Prince William County.

Prince William County Virginia Home. Prince William County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Prince William County Virginia. The current fair market value of real estate situated within your city is calculated by Prince William County assessors.

If your escrow real estate tax payment is wrapped in with your mortgage payment a mortgage services company and you receive a real estate tax bill. Appealing your property tax appraisal. Prince William County - Log in.

King William VA 23086. You can contact Prince William County with general inquiries using the contact info listed below. Submit Business Tangible Property Return.

Copies of subdivision plats are available for purchase at the Clerk of Circuit Court Land Records located at 9311 Lee Avenue 3rd Floor Manassas VA 20110. 4 bed 50 bath 3376 sq. Submit Consumption Tax Return.

Search For Real Estate Agent. Prince William County Virginia. These records can include Prince William County property tax assessments and assessment challenges appraisals and income taxes.

Enter the house or property number. Submit Transient Occupancy Return. Use both House Number and House Number High fields when searching for range of house numbers.

Report a Vehicle SoldMovedDisposed. Request a Filing Extension. Foreclosure and pre-foreclosure listings in selected regions property tax records permit data property maps building violations and more.

Prince William County Real Estate Assessor. Report a change of address. The state also created instructions that Prince William County administrators are obliged to observe in valuing real estate.

Report High Mileage for a Vehicle. These instructions are meant to boost consistency throughout Virginia. Report a Vehicle SoldMovedDisposed.

See details for 1307 Prince William Rd North Myrtle Beach SC 29582. Ad Find Out the Market Value of Any Property and Past Sale Prices. Prince William County is located on the Potomac River in the Commonwealth of Virginia in the United States.

Search 703 792-6000 TTY. 4380 Ridgewood Center Dr Woodbridge VA 22192-5307 Prince William County Contact Info. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

Prince William County VA currently has 416 tax liens available as of March 24. View property data public records sales history and more. Submit Business License Return.

Submit Consumer Utility Return. Prince William County Property Records are real estate documents that contain information related to real property in Prince William County Virginia.

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Prince William Supervisors To Take Up Tax Rate Tuesday Wtop News

Prince William Officials Propose Further Cut In Tax Rate Reduction In Vehicle Assessments Headlines Insidenova Com

Prince William Wants To Hike Property Taxes Introduces Meals Tax

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

Prince William County Launches A New Show Called County Conversation

Prince William County Park Rangers New On Call Number Effective April 1 2022

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenova Com

Prince William Co Residents Decry Proposed Hike In Tax Bills Wtop News

Now Accepting Applications Restore Retail Grant Program